Most people who enroll in an exchange/Marketplace health plan are eligible for an advance premium tax credit (APTC). But it’s important to understand how this is reconciled with the IRS after the year is over.

Most tax credits are simply claimed on your tax return, and aren’t available until you file your taxes. But the health insurance premium tax credit (PTC) is different. You have the option to claim it in full on your tax return like any other tax credit, but most people take the APTC option instead. This means that the credit is divided up across the year and sent to your health insurance company on your behalf, as opposed to paying full price for health insurance and then claiming the tax credit in full on the tax return.

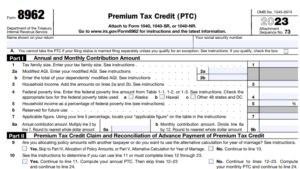

The premium tax credit (PTC) is based on household income (ACA-specific MAGI). But many enrollees don’t know exactly what their income will be for the coming year, when they’re enrolling in a health plan. So APTC is based on projected income, and then you have to true-up with the IRS after the year is over, using Form 8962.

If you overestimate your income and your actual income ends up being lower than you projected (but still in the subsidy-eligible range, as opposed to the Medicaid-eligible range), your actual PTC amount will be larger than the APTC that was paid on your behalf. The IRS will simply credit you the difference when you file your taxes. This means it will either be added to your refund, or used to reduce the amount you owe with your tax return.

But if you underestimate your income and your actual income ends up being higher than you projected, the result is that your actual PTC will be lower than the APTC that was paid on your behalf during the year. This means you’ll have to repay some or all of it to the IRS when you file your taxes.

Depending on income, excess APTC repayment is capped

Fortunately, there are caps on how much you have to repay, as long as your income doesn’t exceed 400% of the poverty level.

Here’s how it works: The details are in the Instructions for Form 8962. The APTC repayment caps are shown in Table 5, on page 15. In a nutshell, as long as your actual household income is less than 400% of the prior year’s poverty level numbers, the amount of excess APTC you have to repay is capped, regardless of how much excess APTC was paid on your behalf.

So if your actual 2023 MAGI isn’t more than 400% of the 2022 FPL for your household size, the repayment cap will apply. Those caps depend on your household income (relative to the prior year’s FPL) and your filing status, and they range from $350 to $3,000 for 2023.

So for example, consider a single person in Colorado whose actual 2023 MAGI ended up being $35,000, but the person projected an income well below that when they enrolled in the fall of 2022. Let’s say their APTC ended up being $3,000 more than it should have been due to the underestimation of their income.

An income of $35,000 is 258% of the 2022 FPL, which means their APTC repayment cap is $900 (since they’re a single filer with an income between 200% and 300% FPL). So instead of having to repay $3,000 to the IRS, they only have to repay $900.

But let’s say their APTC only ended up being $500 more than it should have been. In that case, they would just repay the $500, since that’s less than the $900 cap.

There is no cap on how much excess APTC has to be repaid if your actual household MAGI ends up being 400% of the poverty level or higher. Through at least 2025, people in that income range can and often do qualify for premium tax credits (because the “subsidy cliff” has been temporarily eliminated). But if you underestimate your income and too much APTC is paid on your behalf during the year, there’s no limit on how much of that excess APTC you’ll have to repay if your income ends up being at least 400% of the poverty level.

It’s also important to note that MAGI is based on the whole year’s income, not just your income during the months you had coverage through the exchange. So if you get a job mid-year that bumps your MAGI much higher than it was during the months you had exchange coverage, be aware that your final PTC calculation will be based on the full MAGI. This means you might have to repay some or all of the APTC that was paid on your behalf during the months you had coverage through the exchange.

APTC repayment because you gained access to other coverage

You’re only eligible for PTC in a given month if you are not eligible for affordable employer-sponsored coverage or premium-free Medicare Part A. If you become eligible for either of those mid-year, it’s important to cancel your Marketplace coverage — or be aware that if you keep it, you’ll be paying full price to do so.

So if you become eligible for an employer’s health plan in July and don’t cancel your exchange plan at that point, you’ll have to repay APTC that’s paid on your behalf starting in July.

If you become eligible for Medicare or an employers plan partway through the year, be sure to let me know so that we can cancel your individual/family plan and avoid this scenario. As described above, a new job might result in an increase in MAGI that requires some or all of the APTC from prior months to be repaid).